Risks Commonly Considered to Understand Project Financing Are:

Risk financing is designed to help a business align its desire to take on new risks to grow with its ability to pay for those risks. In a project finance transaction see Practice note Project finance.

Major Types Of Personal Financial Risks Yadnya Investment Academy

Purpose and Need not well-defined.

. Hardware. On september 12 ryan company sold merchandise in the amount of 5800 to johnson company with credit terms of 210 n30. What is Interest Rate Risk.

Compliance risk involves companies having to comply with new rules that are set by the government or by a regulatory body. Interest rate risk is the probability of a decline in the value of an asset resulting from unexpected fluctuations in interest rates. All investments involve some degree of risk.

Assume and accept the risk. In this post I will cover the major risks involved in a typical project. But there is no single definition of project finance.

Project finance is the financing of large international projects like public infrastructure and public utility projects. B Choice B is incorrect. Financial risks arising from the actions of and transactions with other organizations such as vendorscustomersand counterparties.

This type of risk arises due to the movement in prices of financial instrument. Tax benefits financial advisor and risk factors are key issues for the financing activities of the project. Credit risk liquidity risk asset-backed risk foreign investment risk equity risk and currency risk are all common forms of financial risk.

Fortunately there are some risks so common that theyre easy to identify and tackle saving you time money and resources. It is important for any organization to complete a business case if it has not been provided beforehand. Market risk can be classified.

Starting from technologies being discontinued to even changes in government policy. The bond issuer borrows capital from the. Despite more than 230 billion in project finance loans being originated annually the industry still doesnt agree on a consensus definition of project finance.

A cause may be a requirement assumption constraint or condition that creates the possibility of negative or positive outcomes. There are three main sources of financial risk. The cost of the items sold is 4000.

Construction risk In a project financing the primary and typically sole source of income for the repayment of the debt provided by the lenders is the revenue generated by the project see Practice note Project finance. When the project cost is higher than the budgeted funds the risk might shift. On september 14 johnson returns some of the non-defective merchandise which is restored to inventory.

Determine options for recommended corrective action. To deal with such risks companies need to implement a real-time feedback system to know what its customers want. The more risk the more return.

The first project risk example is the risk related to the need and purpose of the projectThis is a medium type of risk but it can get transferred to the high project risk category if the project is impacted by this factor. Every saving and investment product has different. A shortage or mismanagement of project funds resulting from an inflated budget or other constraints is a threat to the projects completion.

Construction for example will add risk to a project because it limits the capacity for collecting rents during this time. Financial risk is caused due to market movements and market movements can include a host of factors. Project risk has its origins in the uncertainty present in all projects.

Below are the five methods with several examples of risk mitigation for each. Project risk is always in the future A risk may have one or more causes and if it occurs it may have one or more impacts. These are risks which cant be controlled or estimated.

The financing is usually secured by the project assets such that the financial institution providing the funds will assume control of the project if the sponsor has difficulties complying with the terms of the transaction. Here is the list of the 9 common project risk that we will be learning in detail including the ways to tackle them. Idiosyncratic risk is specific to a particular property.

Planning - Risk Management. Risk in Project Finance Project finance transactions typically involve the direct financing of infrastructure and industrial projects. Monte Carlo analysis is a simulation technique used through software.

In case the sponsor disagrees with the terms of the transaction the financial institution providing the funds can gain. This will not allow off site meeting. Budget cut is among the most challenging risks as it forces you into a situation where you need to satisfy clients requirements while being low on resources.

The project generally encounters challenging social and environmental. Some risk factors that should be taken into account are completion risk cost overrun regulatory and political risk and technology risk. Apply the Delphi technique.

Scope creep the project grows in complexity as clients add to the requirements and developers start gold plating. A Choice A is incorrect. And when developing a parcel from the ground up investors take on more types of risk than just the.

Apply the critical path method. This risk includes changes in scope caused by the following factors. The process proposes the use of the following tools and techniques.

For example there may be a new minimum wage that must be implemented immediately. Financial risks arising from an organizations exposure to changes in market prices such as interest rates exchange rates and com-modity prices 2. Ryan uses the periodic inventory system and the net method of accounting for sales.

The first strategy for mitigating project risks is to assume and accept the risks involved. Interest rate risk is mostly associated with fixed-income assets eg bonds Bonds Bonds are fixed-income securities that are issued by corporations and governments to raise capital. In general as investment risks rise investors seek higher returns to compensate themselves for taking such risks.

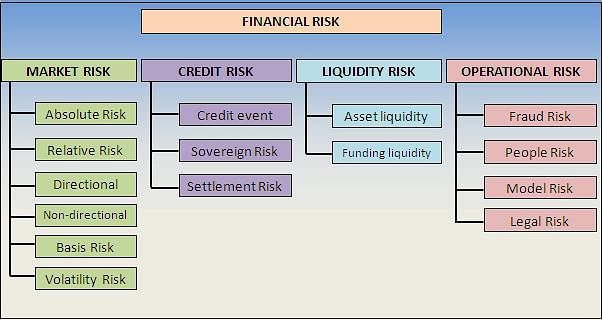

In finance risk refers to the degree of uncertainty andor potential financial loss inherent in an investment decision. The direct financing of infrastructure and industrial projects typically includes the following risks. Based on this financial risk can be classified into various types such as Market Risk Credit Risk Liquidity Risk Operational Risk and Legal Risk.

When working in project management you can use five standard strategies to reduce or eliminate risks.

Risk Definition Types Adjusment And Measurement

What Is Financial Risks And Its Types Updated

Financial Risk Types Of Financial Risk Advantages And Disadvantages

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Comments

Post a Comment